Table Of Content

For a conventional loan, you’ll need to put at least 20% down to avoid PMI. If you put down less than this, you’ll have to pay PMI until your loan has reached 80% of the original home value or you’ve reached the halfway point of your repayment term. Other than what you can afford, the biggest factor affecting your down payment is the type of mortgage you want to qualify for. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely.

First-Time Home Buyers And Down Payments: 73% Of Buyers Put Down Less Than You Think

Most people need short liquidity on their home savings (fewer than ten years) so it’s best to keep the funds out of investments that are risky or tie up your money for long periods. Instead, consider FDIC-insured accounts, like short-term CDs or high-yield savings accounts. Look for an account that pays a high interest rate to make your money work for you.

Best Mortgage Lenders

She holds a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan. According to our analysis, the majority (73%) of first-time buyers put 15% or less down. Financial markets currently see two rate cuts by the Bank of England this year.

State and Local Assistance Programs

Shop around for the best mortgage terms and lowest closing costs. Pay close attention to fees like origination fees, discount points and underwriting fees. Don’t be afraid to ask questions about them and negotiate with lenders to get some of them reduced or waived. As housing costs soar, Gen Z and Millennial home buyers are turning to family for help with house down payments. How much you ultimately will be approved for depends on several factors specific to your situation.

You can put as little as 3.5% down with a Federal Housing Administration FHA loan. The property you’re buying must comply with standards set by the U.S. Department of Housing and Urban Development for single-family and condo homes and be within FHA loan limits. In fact, many people do put down less than 20% when buying a home.

It will help you determine what size down payment makes more sense for you given the loan terms. Ally Bank has a Fannie Mae-backed HomeReady loan that lets qualified borrowers put down as little as 3% on a fixed-rate mortgage with no lender's fee and an online preapproval process. You'll need at least a 620 credit score to be considered, however, and have an annual income that doesn't exceed 80% of the median income in your area. Get Forbes Advisor’s ratings of the best mortgage lenders, advice on where to find the lowest mortgage or refinance rates, and other tips for buying and selling real estate.

Type of home loans to consider

How To Get A No-Down-Payment Mortgage - Bankrate.com

How To Get A No-Down-Payment Mortgage.

Posted: Mon, 08 Apr 2024 07:00:00 GMT [source]

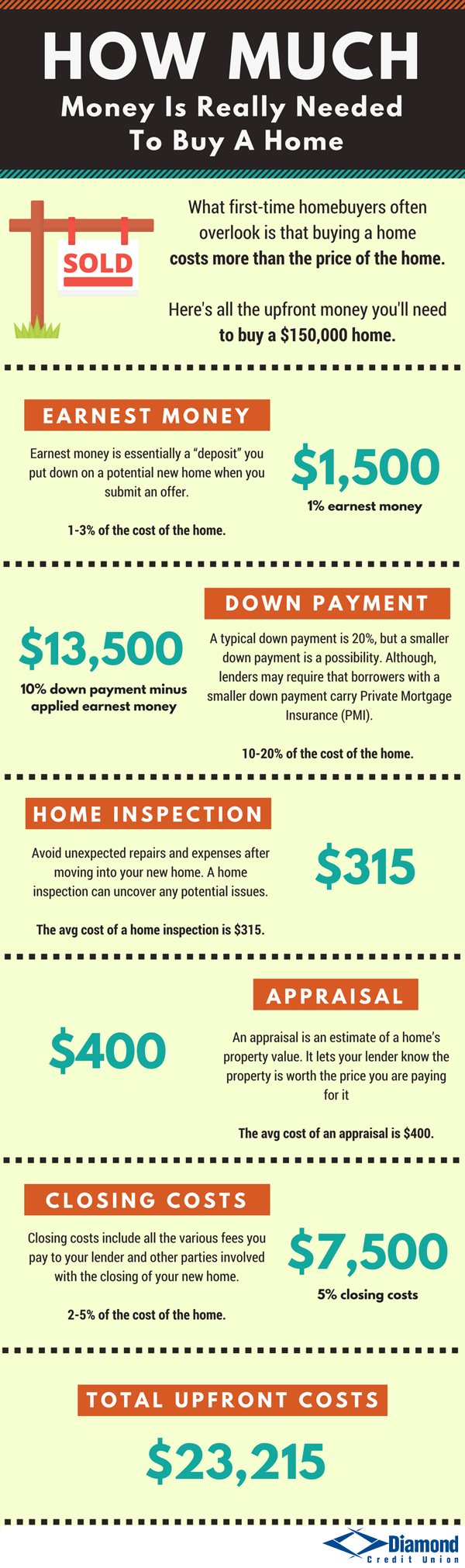

The calculator divides that total by 12 months to adjust your monthly mortgage payment. Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. A down payment is your equity in a home at the moment you buy it. Lenders require homebuyers to make a down payment for most mortgages.

Indiana First-Time Home Buyer 2024 Programs and Grants - The Mortgage Reports

Indiana First-Time Home Buyer 2024 Programs and Grants.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

Learn when that may change and explore other tax breaks you can benefit from. When we take a look at down payments by the homeowner’s age, we found that first-time buyers aged 25 and under were nearly twice as likely to buy a home with no money down than other age groups. This data proves that it’s very common to buy a house with less than 20%, and a down payment doesn’t have to stand in the way of one’s dream of homeownership. How much you need for a down payment will depend on the type of mortgage you’ve applied for, among other factors. In 93 metro areas analyzed by Redfin, the agency found all of them needed at least a 30% salary increase to buy a median-priced home. Prospective home buyers in at least half those areas needed to make a minimum of $100,000 a year.

In addition, you’ll have that much more instant equity to pull from, plus a lower mortgage insurance premium or the ability to avoid these premiums altogether. For the most common types of mortgages, lenders charge premiums when you put less than 20 percent down. A higher down payment helps reduce your monthly mortgage payments, which can keep your DTI at a reasonable level. Your debt-to-income ratio (DTI) refers to the percentage of your monthly income that goes toward paying off debt. Since lenders look at DTI to make lending decisions, having a high DTI can keep you from qualifying for other loans in the future. Many believe they need a 20% down payment to buy a house, but is that true?

While your lender may be comfortable with lending you money with a low percentage down payment, many condo buildings have maximum financing restrictions. Generally, condos require owners to purchase with a minimum down payment of 10%, or 90% max financing, but this can vary from building to building. Your interest rate significantly impacts your monthly payment, which in turn affects how much income you'll need to earn to purchase a $400k home. You need to make about $3,000 more per month to afford the same home at an 8% rate versus 5%.

But buyers should only employ their 401(k) if they know they are secure in their career. Unless you are lucky enough to be able to make an all-cash offer, California buyers will need to save up a sizable portion of funds for a down payment when using mortgage financing. Making a large down payment reduces your monthly payment, especially if you can reach 20% down. This eliminates mortgage insurance, lowering your overall payment considerably. Making a smaller down payment also has its benefits, the most obvious being a smaller amount due at closing.

An FHA loan is ideal for first-time buyers with less-than-perfect credit scores and offers down payments as low as 3.5%. Unlike conventional mortgages, mortgage insurance includes both an upfront amount and a monthly premium. Redfin reports that the median home sales price in the United States is $411,887. The 20% down payment rule is now a thing of the past; the average first-time homebuyer puts down about 8% of the home’s purchase price. However, this still represents $32,950 for a down payment on an average home—a hefty amount for most people.

Generally speaking, older buyers make larger down payments than younger buyers. As you build wealth (including home equity) over time, you might have a little more to apply toward a down payment. If these numbers seem steep, remember the amounts will be lower for a house below this price point. After all, plenty of people — especially first-time home buyers — are house-hunting below the $400,000 mark. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender.

It follows interest rates stabilising, Halifax says, after a sharp rise over the past two years which squeezed mortgage affordability. The Zoopla research looked at the average home buyer taking out a 70% loan-to-value mortgage. The biggest impact of rising interest rates has been in southern England where house prices are higher.