Table Of Content

Explore mortgage options to fit your purchasing scenario and save money. With an upfront down payment of 20% at $72,600 plus necessary closing or settlement costs averaging 4.5% of the purchase price, the sum needed for the house purchase would be $88,935. Because jumbo borrowers present more risk for a lender, expect to put down 10% to 20% of the purchase price.

USDA loan (government loan)

Staff at the UK's biggest airport are set to walk out during the early bank holiday in May, with their union warning planes could be "delayed, disrupted and grounded". We also want to know how you give them the money (cash, bank transfer, app) - and if they have to do anything in return. Home prices have also remained relatively steady, meaning that those who can still afford a home need to readjust their budgets, while others have been priced out. In Los Angeles, the high cost of housing has also played a role in making it the most overcrowded large U.S. county.

financing a homeFHA loan down payments decoded

In Los Angeles and Orange counties, the cap is $970,800, meaning you can buy a $1.2 million house with a 20% down payment. Borrowers who leave their job must pay the loan back at the due date of their next federal income tax date. A failure to do so incurs the same penalties levied against buyers who make a withdrawal from their 401(k). Buyers emboldened by a commission rebate can make higher offers or use the funds to replenish their savings after their down payment.

How we make money

In the second quarter of 2023, Louisiana home buyers made the lowest average down payment of 9.2% at $6,729, while Washington, D.C. Has the highest down payment percentage amount at 20.4%, with a $100,800 median down payment due to the area’s expensive housing market. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. Loan approval is subject to credit approval and program guidelines.

If a single Californian is purchasing a home for themselves, they must make less than $95K. Two people buying a house together cannot earn over $150,000 combined before taxes if they plan to use FHA loans. In the U.S., most conventional loans adhere to guidelines and requirements set by Freddie Mac and Fannie Mae, which are two government-sponsored corporations that purchase loans from lenders. Conventional loans normally require a down payment of 20%, but some lenders may go lower, such as 10%, 5%, or 3% at the very least.

What Are The Minimum Down Payment Requirements?

The down payment requirements for jumbo loans vary by lender and range from 10% to 30%, with 20% being the most common threshold. For example, you can be eligible for a conventional loan with as little as 3% down. Government-backed programs such as FHA loans, VA loans or USDA loans can require 0% to 10% but are more likely to charge upfront and annual fees. The National Association of Realtors (NAR) states that the average down payment on a house for first-time home buyers is 6% versus 17% for repeat buyers in 2022. However, the share of first-time buyers fell to 22% in 2022, dropping from 34% in 2021.

You may be able to buy a house with no down payment if you qualify for a down payment assistance program. These are often city- or state-based, and they usually provide no more than the bare minimum you need to qualify for a loan, such as 3%. The Community Seconds and Affordable Seconds programs are two ways to buy a home with 0% down. The average down payment on a home is 12%, according to the National Association of Realtors. The amount you should put down when you’re buying a home is a personal decision that depends on what’s best for your finances. You have to put down some minimum amount to qualify for a mortgage.

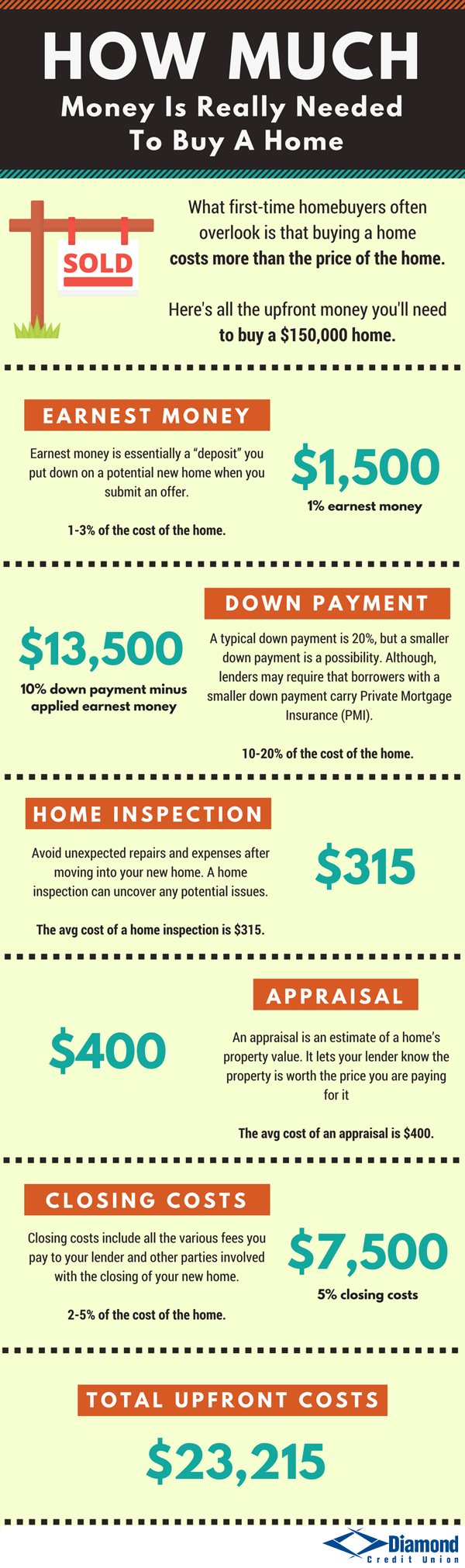

Are there other costs to be aware of when buying a home?

The minimum down payment will largely depend on the type of loan you choose for your primary or secondary residence or investment property. You likely won’t put any money down if you qualify for a USDA or VA loan. A preapproval is based on a review of income and asset information you provide, your credit report and an automated underwriting system review. The issuance of a preapproval letter is not a loan commitment or a guarantee for loan approval. Preapprovals are not available on all products and may expire after 90 days. It can be beneficial to work with someone who knows the answers to all these questions.

Average Down Payment For First-Time Homebuyers - Bankrate.com

Average Down Payment For First-Time Homebuyers.

Posted: Fri, 23 Feb 2024 08:00:00 GMT [source]

The most common way to cover this cost is to pay for it in a monthly premium that's added to your mortgage payment. Many lenders offer conventional loans with PMI for down payments as low as 5%, and some as low as 3%. Buyers can start by figuring out how much they can afford to pay each month and set savings goals based on their target purchase price. Buying a home gives you equity in a long-term investment, but not all buyers can afford costly down payments and closing costs.

The views expressed in this article do not reflect the official policy or position of (or endorsement by) JPMorgan Chase & Co. or its affiliates. Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s).

Missouri First-Time Home Buyer 2024 Programs and Grants - The Mortgage Reports

Missouri First-Time Home Buyer 2024 Programs and Grants.

Posted: Fri, 26 Apr 2024 07:00:00 GMT [source]

PMI protects the lender if the buyer stops making payments on the loan. Borrowers can request the lender drop the PMI requirement once the equity in the home reaches 20%. The less you borrow, the smaller your monthly mortgage payments will be, leaving extra funds to budget for repairs and other monthly expenses. In addition to the down payment, you’ll need to set aside money for closing costs.

And just a 1 – 2 mortgage point drop in your interest rate can save you thousands of dollars over the life of your loan. View today’s mortgage rates or calculate what you can afford with our mortgage calculator. After evaluating your budget and what you need from your home, it's time to consider all your options.

This type of loan is only available for U.S. military veterans and active duty servicemembers.

You can even put 0% down if you qualify for a down payment assistance program, a VA loan or a USDA loan. The size of your down payment doesn’t need to deter you from buying a home. A mortgage pre-approval is an official step where a lender verifies your financial information and credit history. Your mortgage application collects information regarding your estimated down payment amount, income, employment, debts, assets, credit report, and credit score. Bear in mind that the down payment is just one of many home-related expenses. You may want to budget up to 1% of the home’s value for annual maintenance costs.

Add in closing costs, moving expenses and needed home maintenance and the total becomes even more daunting. Aspiring buyers typically ask, “Is it best to put 20% down on a house? ” This is a laudable goal as a minimum 20% down payment waives private mortgage insurance (PMI) on conventional loans. However, eligible borrowers can put down as little as 3% but pay additional fees. If you put less than 20% down on a conventional loan, you may need to pay private mortgage insurance (PMI).

Let’s look at the actual data surrounding first-time home buyers and down payments. Your down payment is one way mortgage lenders can assess your finances, establish your creditworthiness and verify that you can repay your loan. A down payment proves to a lender that you’re serious about buying a home and willing to invest your money into the property. You’ll need to put 20% down to avoid paying private mortgage insurance (PMI) on a conventional mortgage loan. PMI is insurance that protects a lender if a borrower defaults on their home loan.

No comments:

Post a Comment